| Toronto, ON – November 11, 2021 – White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA: 29W) (the “Company”) is pleased to announce an updated mineral resource estimate for the VG deposit on its QV project which is located approximately 85 km south of Dawson City and 11 km north of the Company’s flagship Golden Saddle and Arc deposits (Figure 1) which contain a combined mineral resource of 1,139,900 ounces Indicated at 2.28 g/t Au and 402,100 ounces Inferred at 1.39 g/t Au(1) in west-central Yukon, Canada. This work forms part of the Company’s fully funded 2021 exploration program backed by partners Agnico Eagle Mines Limited (TSX: AEM, NYSE: AEM) and Kinross Gold Corporation (TSX: K, NYSE: KGC) on its extensive 420,000 hectare land package in the emerging White Gold District, Yukon. Highlights Include: The updated mineral resource for the VG deposit comprises near-surface Inferred Resources of 267,600 ounces of gold (5,264,000 tonnes at an average grade of 1.62 g/t gold), representing a 16% increase in Inferred Resources compared to a historical 2014 resource estimate(1) which remains open in multiple directions (Figures 2 & 3). Gold mineralization at the VG deposit appears very similar to that at the Company’s Golden Saddle deposit.Opportunities exist at the VG deposit to quickly upgrade a significant portion of Inferred Resources to Indicated, as well as for expansion of mineralization at depth and along strike.Several other prospective targets on the property have received limited exploration work and offer potential for additional discoveries. The 2021 work program continues to demonstrate extensive gold mineralization in the White Gold district and the potential for new discoveries and continuing to increase the Company’s significant defined resource base.Results from diamond drilling on the Betty and Ulli’s Ridge Targets and other exploration activities will be forthcoming in due course.The Company is pleased to announce its attendance at the Mines and Money London conference from December 1st to 2nd, 2021 and invites interested parties to register to learn more about the Company’s unique district-scale gold exploration opportunity with significant defined resources, recent discoveries and new discovery potential in the prolific White Gold District, Yukon, Canada. Register here: https://minesandmoney.com/london/register |

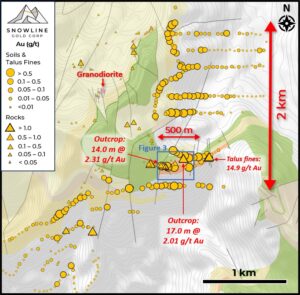

| Figure 1 – QV Property Scale Location Map |

| Figure 2 – QV Property : VG Deposit Cross Section |

| Figure 3 – QV Property : VG Deposit Isometrics of VG Zone |

| Figures accompanying this news release can be found at: https://whitegoldcorp.ca/investors/exploration-highlights/ “When we strategically acquired the QV Project in 2019 we believed that there was a significant opportunity to increase the size of the resource in addition to the immediate increase of our total resource base in the area, and were very interested in the prospectively of several untested targets on the property. We are very pleased to have already increased the resources at the VG deposit with very limited drilling and feel confident that excellent opportunities exist to quickly upgrade and further expand the resources, further increasing our already significant defined resource base,” stated David D’Onofrio, CEO. Resource Estimate Details The current resource estimate for the VG deposit was carried out by Arseneau Consulting Services (“ACS”) and is reported in accordance with the guidelines of the Canadian Securities Administrators National Instrument 43-101 (“NI 43-101”) and has been estimated in conformity with generally accepted CIM “Estimation and Mineral Resource and Mineral Reserve Best Practices” guidelines. Mineral resources are not mineral reserves and do not have demonstrated economic viability. The current resource estimate incorporates assay results from 23 diamond drill holes (4,324m) and 8 reverse circulation (RC) drill holes (870m). An additional 24 rotary air blast (RAB) drill holes totalling 1,758 m were utilized to assist modelling the mineralized zones, but were not used in grade estimation. All drilling except for the 8 RC holes drilled by the Company in 2019 was completed between 2012 and 2017 by the previous owner, Comstock Metals Ltd. (“Comstock”, TSX-V: CSL). This compares to 16 diamond drill holes (3,278m) having been used for the historical 2014 resource estimate. The Mineral Resource Estimate for the VG deposit, with an effective date of October 15, 2021, is summarized in Table 1 below. The resources are situated near-surface and are potentially amenable to open pit mining methods. The Company’s updated total mineral resources for on its Yukon projects is summarized in Table 2 below. Table 1. VG Deposit Mineral Resource Statement, Effective Date October 15, 2021. |

| Notes: The Mineral Resource Estimate has been constrained to a preliminary optimized pit shell, using gold recovery of 92%, operating costs of CDN$33.50/tonne, pit slope=50 degrees, SG=2.65, and a gold price of US$1,600 per troy ounce. Mineral Resources were estimated by Ordinary Kriging in 20m by 20m by 10m blocks.Top cuts to each of the estimated zones were applied with capping values between 3 g/t to 10 g/t Au.A fixed bulk density of 2.65 t/m3 was assigned to the model based on the average of all density measurements collected from the mineralized zones. Mineral resources were prepared in accordance with NI 43-101, Companion Policy 43-101CP, and the CIM Definition Standards for Mineral Resources and Mineral Reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.Rounding may result in apparent summation differences between tonnes, grade, and contained metal content. Table 2. Summary of Mineral Resources, White Gold Corp., Yukon, Canada |

| The Mineral Resource estimate is based on the combination of geological modeling, geostatistics, and conventional block modeling using the Ordinary Kriging method of grade interpolation in Geovia GEMS software. Four mineralization solids were created to outline mineralization domains greater than 0.5 g/t Au. The solids constrained drill hole intercepts were composited into 2.0 m lengths with all unsampled values assigned zero grade. Gold grades for the model were estimated in three successive passes. The first pass used a search ellipse with dimensions of 95 m X 30 m X 9 m in the X, Y, and Z directions respectively which represents 80% of the correlogram ranges. Pass two used the full correlogram range of 120 m X 37 m X 11 m in the X, Y, and Z directions respectively. The third pass search ellipse doubled the correlogram range in the Y and Z directions. For all three passes a minimum of 6 and maximum of 20 composites were required to generate a resource block, with no more than 5 composite allowed from any one drill hole. Resources were estimated into non rotated blocks with dimensions of 20 m X 20 m X 10 m in the X, Y and Z dimensions respectively. Top cuts to each of the estimated zones were applied with capping values ranging from 3 g/t to 10 g/t Au. Qualified Persons, Technical Information and Quality Control The Mineral Resource Estimate for the QV Project was prepared by Dr. Gilles Arseneau of Arseneau Consulting Services (ACS), an Independent Qualified Person (“QP”) as defined under NI 43-101, who has reviewed and approved the contents of this news release. The technical content of this news release has also been reviewed and approved by Terry Brace, P.Geo. and Vice President of Exploration for the Company who is also a QP as defined under NI 43-101 – Standards of Disclosure of Mineral Projects. A technical report to support the Mineral Resource Estimate for the QV project, prepared in accordance with NI 43-101, will be filed on SEDAR (https://www.sedar.com/) and the Company’s website (https://www.whitegoldcorp.ca/) within 45 days of the issuance of this news release. QA/QC All sample analytical work from the VG deposit diamond drilling (Comstock) and RC drilling (the Company) programs was carried out at either ALS Global Laboratories of North Vancouver or Bureau Veritas Laboratories of Vancouver, BC, both of which are fully accredited analytical facilities. All programs have been completed following CIM best practices including the implementation of QA/QC sampling protocols and the submission of standards, blanks, and duplicate samples. All samples were assayed for gold via fire assay along with multi-element ICP-MS (Inductively Coupled Plasma Mass Spectrometry). Diamond drill core sampling protocols consisted of the collection of 0.5-2.0 m samples over the entire length of the drill hole with sample length varying based upon lithology and mineralization style. All drill core was cut in half with a diamond saw, with half of the core placed in sample bags and the remaining half securely retained in core boxes at the Project’s core storage yard. For RC holes, continuous samples were collected at 1.5m intervals. Returned rock chips were run through a 3-tiered riffle splitter and approximately 1/8th of the returned chips was collected for assay. For both RC and diamond drill core, all samples were organized into secure batches which included the insertion of standards, blanks and duplicate material. Samples were then delivered securely to the chosen laboratory by chartered flight or courier. |