Vancouver, B.C., October 12 , 2021 – Ximen Mining Corp. (TSX.v: XIM) (FRA: 1XMA) (OTCQB: XXMMF) (the “Company” or “Ximen”) announces that it has received approval for exploration drilling on the Providence Property near Greenwood in southeastern BC. |

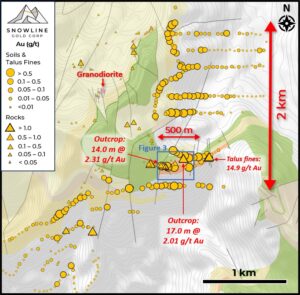

Property map showing Providence Property near Greenwood, B.C. Property map showing Providence Property near Greenwood, B.C. |

The Providence Multi-Year Area Based permit approval for this year will allow 4 new drill sites. Multiple holes can be drilled from each of the sites, so the permit allows for approximately 1,600 meters to be drilled this year. Ximen’s Providence property adjoins the historic Providence mine, for which B.C. Minfile records indicate 1,368,075 ounces of silver, 5,896 ounces of gold, 402,690 pounds lead and 260,086 pounds of zinc were recovered from 10,426 tonnes mined. Ximen received significant results for drill holes 2 and 3 on the property, including 147.25 grams per tonne silver over 1.0 meters in hole 20-02 (96.47 to 97.47 meters), and 94.9 grams per tonne silver over 0.83 meters in hole 20-03 (111.73 to 112.76 meters) as previously announced in a news release dated February 22, 2021. Drill holes planned for this year will follow-up these intercepts, located northeast of the historic Providence silver mine. |

Perspective view of the historic Providence mine 3D model showing the 2020 drill hole intercepts. Perspective view of the historic Providence mine 3D model showing the 2020 drill hole intercepts. |

Readers are cautioned that historical information including assay results referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate. Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release. The Company is pleased to announce that it has arranged a non-brokered private placement of 4,545,455 flow through shares at a price of $0.22 cents per share for gross proceeds of $1,000,000. Each Flow-Through share consists of one common share that qualifies as a “flow-through share” as defined in subsection 66(15) of the Income Tax Act and one-half transferable common share purchase warrant. Each whole warrant will entitle the holder to purchase, for a period of 36 months from the date of issue, one additional non-flow-through common share of the Issuer at an exercise price of Cdn$0.35 per share. The term of the warrants may be accelerated in the event that the issuer’s shares trade at or above a price of $0.55 cents per share for a period of 10 consecutive days. In such case of accelerated warrants, the issuer may give notice, in writing or by way of news release, to the subscribers that the warrants will expire 20 days from the date of providing such notice. The net proceeds from the Offering will be used by the Company for exploration expenses on the Company’s British Columbia mineral properties. A finder’s fee may be paid to eligible finders in accordance to the TSX Venture Exchange policies. All securities issued pursuant to the offering will be subject to a hold period of four months and one day from the date of closing. The offering and payment of finders’ fees are both subject to approval by the TSX-V. The Company also announces that it has closed the first and second tranches of the non-brokered private placement first announced on October 4, 2021 for gross proceeds of $300,000. A total of 1,000,000 units were issued for the first tranche and 500,000 units for the second tranche. Each Unit consists of one common share at a price of $0.20 per share and one transferable common share purchase warrant (a “Warrant”). Each whole warrant will entitle the holder to purchase, for a period of 36 months from the date of issue, one additional common share of the Issuer at an exercise price of $0.35 per share. The term of the warrants may be accelerated in the event that the issuer’s shares trade at or above a price of $0.45 per share for a period of 10 consecutive days. In such case of accelerated warrants, the issuer may give notice, in writing or by way of news release, to the subscribers that the warrants will expire 20 days from the date of providing such notice. The hold expiry date for the first tranche is February 8, 2022 and the second tranche is February 9, 2022. No finders’ fees were paid on these tranches. The net proceeds from the Offering will be used by the Company for exploration expenses on the Company’s British Columbia mineral properties and general working capital. The closing of the first tranche of the private placement financing is subject to final TSX-V approval. |

On behalf of the Board of Directors, Christopher R. Anderson President, CEO and Director 604 488-3900 Investor Relations: Sophy Cesar | 604 488-3900 | ir@XimenMiningCorp.com |