Orestone Mining Corp. (TSX Venture Exchange Symbol: ORS) (Frankfurt: WKN: O2R1) is pleased to announce a non-brokered private placement consisting of up to 5,000,000 common shares (“Flow-Through Shares”) at a price of $0.13 per Flow-Through Share and up to 5,000,000 units (“Units”) at a price of $0.09 per Unit for aggregate gross proceeds of up to $1,100,000 (the “Offering”). Each Unit will consist of one common share of the Company and one common share purchase warrant. Each Warrant will be exercisable for one common share of the Company at a price of $0.15 for one year from the date of issuance. Each Flow-Through Share of the Company to be issued on a “flow-through” basis pursuant to the Income Tax Act (Canada).

The closing date will be on or about March 10, 2021 or such later date as the Corporation may determine. Closing will be subject to receipt of conditional approval by the TSX Venture Exchange (the “Exchange”). Subject to the approval of the Exchange and applicable laws, the Company may pay a cash fee of 7% of the proceeds of the Offering to certain arm’s length finders.

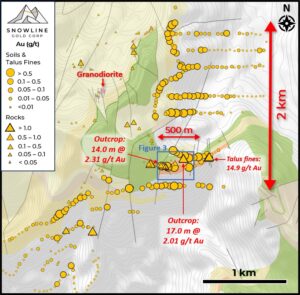

The Company will use the proceeds of the Offering to incur qualifying Canadian exploration expenses in connection with exploration drilling on the Company’s Captain Gold Copper Porphyry Project located in British Columbia, Canada. The Company will renounce such applicable exploration expenses to subscribers under the Offering.

It is anticipated that certain directors, officers and other insiders of the Company will acquire Units and or Flow-Through Shares under the Offering. Such participation will be considered to be “related party transactions” within the meaning of TSX Venture Exchange Policy 5.9 and Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”) adopted in the Policy. The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in respect of related party participation in the Offering as neither the fair market value (as determined under MI 61-101) of the subject matter of, nor the fair market value of the consideration for, the transaction, insofar as it involves the related parties, is expected to exceed 25% of the Company’s market capitalization (as determined under MI 61-101).

The securities referred to in this news release have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any applicable securities laws of any state of the United States, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons (as such term is defined in Regulation S under the U.S. Securities Act) or persons in the United States unless registered under the U.S. Securities Act and any other applicable securities laws of the United States or an exemption from such registration requirements is available. This press release does not constitute an offer to sell or a solicitation of an offer to buy any of these securities within any jurisdiction, including the United States.

Orestone Mining Corp. is a Canadian based company that owns a 100% percent interest in the 37 square kilometre Captain gold-copper porphyry project in north central British Columbia. The project hosts a gold-copper porphyry system which encompasses a cluster of large targets (see website for maps) located 41 kilometres north of Fort St. James, B.C. and 30 kilometres south of the Mt. Milligan copper-gold mine. The Captain Project features relatively flat terrain, moderate tree cover and an extensive network of logging and Forest Service roads suitable for exploration year around.

For more information please visit: www.orestone.ca

ON BEHALF OF ORESTONE MINING CORP.

David Hottman

CEO